By Falco

16 Jun 2025

• The Israel-Iran conflict injects more inflation into the global economy.

• Oil is at risk of further upside wiping out the recent weakness and its benefit to asset prices.

• Fed is likely to signal its ongoing reluctance to cut rates.

• Bonds range trading - we remain short-duration.

• UK equities reach a new high but the new budget struggles to convince.

• A pro-gold and non-US assets stance remains valid for global investors.

Just as the global macro narrative was on its way to stabilisation—with softer-than-expected US inflation, resilient global growth data, and early signs of moderation in trade rhetoric—escalating tensions between Israel and Iran have reintroduced a disruptive risk premium to global markets.

Investors had begun to hope for a more benign policy environment and fading inflation concerns, but the geopolitical backdrop now threatens to reverse recent gains in sentiment and market pricing.

Chart 1: Global Economic Surprise Index Had Improved but is Now at Risk of a Down Leg

The index shows the degree to which economic data is coming in above or below expectations.

Source: Bloomberg

Hormuz in Focus: Iran’s Oil Flows and Strategic Risk

As of this year, Iran’s oil output has recovered to 3.2 million barrels per day (mbd), nearly double its 2021 low, with exports of 1.8 mbd of crude and 350,000 bpd of refined products. The bulk of these supplies are routed through the Strait of Hormuz—an artery for 30% of global seaborne oil and 20% of LNG shipments.

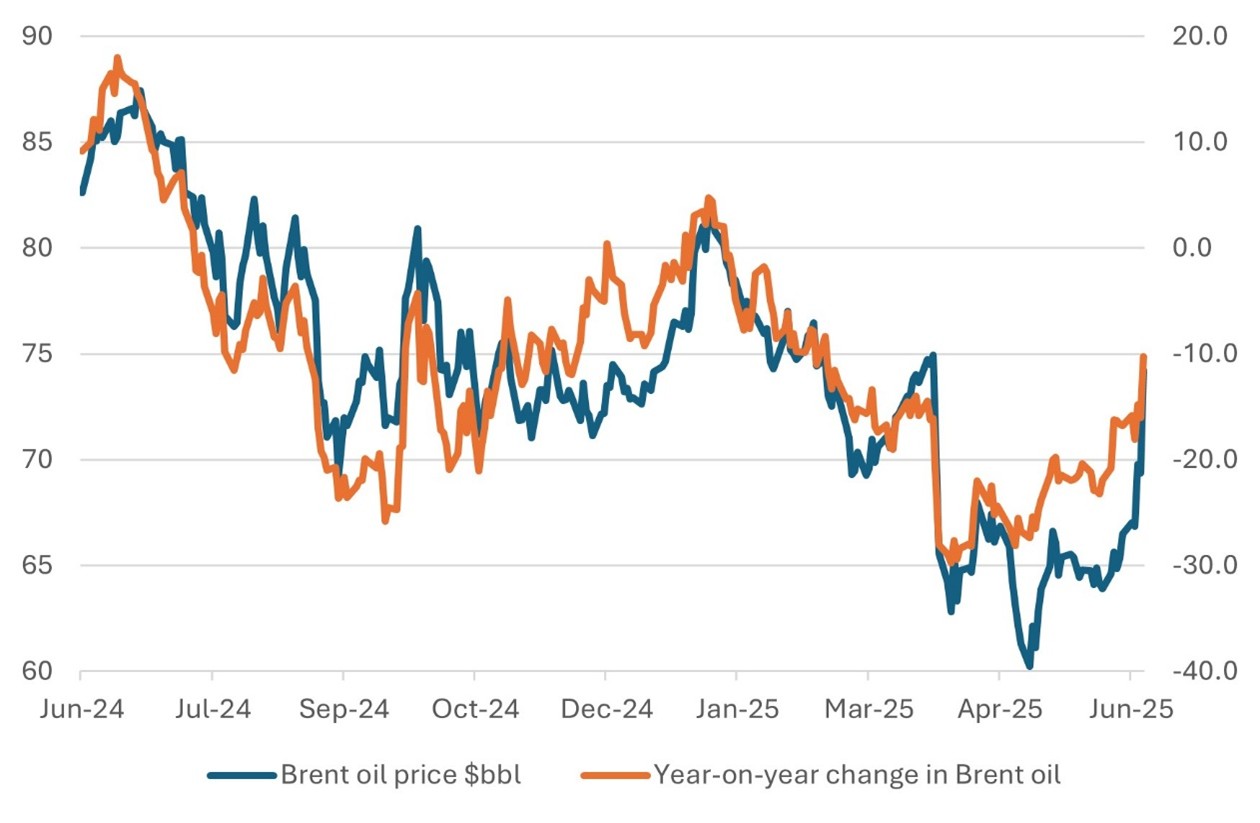

Historically, Iran has avoided obstructing this vital oil corridor, conscious of the economic blowback such a move would trigger—both for itself and key partners like China. While a full closure of the strait remains improbable, even modest disruptions or proxy conflicts could drive oil prices sharply higher. Brent currently sits around $75, but a renewed risk premium could push it into the high $80s or beyond. Such a move would likely reprice inflation expectations and undermine the current consensus on policy easing.

Markets may also be underestimating the psychological effect of geopolitical risk on sentiment and capital allocation. Keep an eye on any pickup in oil volatility (OVX), shifts in inflation and flows into real assets if tensions persist.

Fed Meeting Preview: Dissonance Between Markets and Policymakers

The Federal Reserve is expected to hold rates steady this week, marking the fourth consecutive time the central bank has hit pause. However, given the rapidly changing geopolitical scenario, attention will turn to the updated dot plot, which is likely to show a shift: the median forecast currently points to just one cut in 2025, with up to five FOMC members potentially projecting no cuts at all.

While recent inflation data has provided short-term relief, any resulting reprieve is now fading. A key contributor—declining oil prices—has likely bottomed. As geopolitical risks drive oil prices higher, energy’s recent disinflationary drag (~20–30bps over the past three months) may reverse. This, coupled with the 3 July tariff deadline and limited progress on trade negotiations, presents a renewed threat to price stability.

Chart 2: Core PCE inflation Moving Closer to Fed’s Target

Source: Bloomberg

Market pricing of rate cuts remains more dovish than the Fed’s signalling, with two cuts expected by December. Investors are increasingly focused on mid-2026 when current Fed Chairman Jerome Powell’s term ends. The prospect of a leadership change at the Fed—and the potential for a more dovish successor—has triggered speculative positioning around a June 2026 rate cut.

Political pressure is also building. President Trump has publicly urged a 100-bp rate cut, though ironically, the inflationary impact of his tariff policies may be one of the main factors why the Fed is keeping rates elevated.

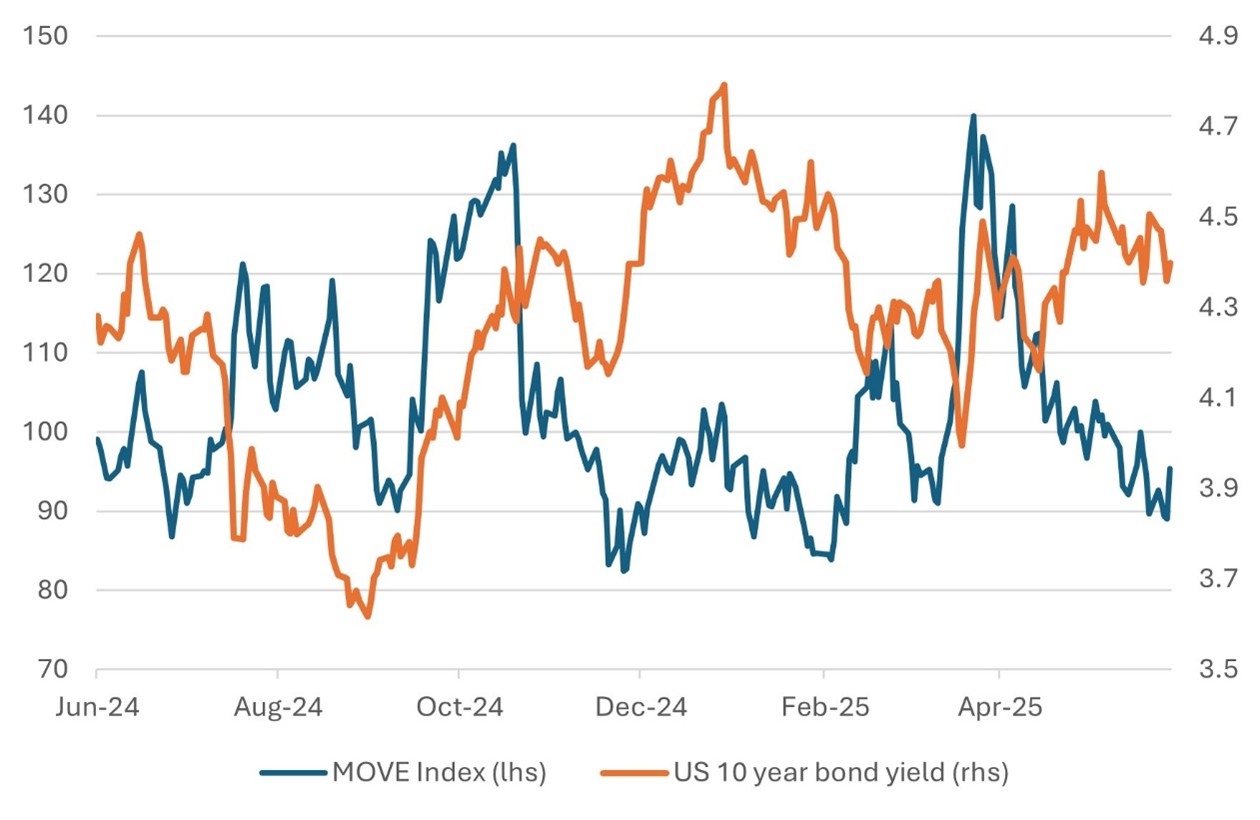

Despite this tension, US bond markets have stabilised. The MOVE Index, a measure of bond market volatility, has retraced from its April highs, and yields are range-bound, barring a sharp deterioration in the Middle East.

Chart 3: Market pricing of the number of rate cuts by end of 2025

Source: Bloomberg

Meanwhile, political pressure is building. President Trump recently called on the Fed to slash rates by a full percentage point. Ironically, had the tariffs not been implemented, the Fed might already be easing. Yet, with unemployment still at 4.2% and wage growth running above comfort levels, and with immigration curbs likely to limit workforce expansion and hence push unemployment rates down, policymakers understandably remain cautious.

The US bond market is in a middling space with economic growth marginally better than expected, as some of the worst fears of the impact of tariffs on inflation diminished. Barring a sharp deterioration in the Iran/Isreal conflict, yields should stay range bound.

Chart 4: MOVE Bond Market Volatility Index  Source: Bloomberg

Source: Bloomberg

UK Equities: Value Rotation or Temporary Pop?

The FTSE 100 hit an all-time high last week, delivering an 8.5% YTD price return—bolstered further by sterling’s 8% appreciation versus the US dollar. While structural challenges persist, value plays in UK industrials and energy have benefited from capital rotation. London’s equity market continues to lose listings to New York, underscoring ongoing competitive pressures.

Meanwhile, the UK government's latest public spending review sets out ambitious plans for current expenditure growth, particularly for the NHS and defence. However, 90% of incremental spending is concentrated in early 2026, raising doubts about medium-term fiscal sustainability. Tax increases in the autumn budget appear increasingly likely.

On capital expenditure, an extra £120 billion has been pledged—but with little clarity on productivity returns, and questionable implementation credibility. The policy mix leans toward politically driven spending under the guise of fiscal prudence and may not be enough to shift the UK out of its structural growth malaise.

Chart 5: UK FTSE 100 Hits an all-time High

Source: Bloomberg

Positioning View: Resilient Diversification in a Fractured World

Despite geopolitical tensions, the US dollar has not displayed the safe-haven strength typically seen during previous crises. This may reflect confidence in US real yields and the country’s relative economic resilience—but it also underscores the case for diversified currency exposure.

We maintain a constructive stance on non-US equities, continue to favour short-duration fixed income, and remain overweight gold. The combination of geopolitics, trade fragility, and uneven inflation progress suggests that portfolios need real asset ballast and regional diversification. Tactical discipline remains essential as investors navigate the intersection of policy divergence and geopolitical asymmetry.

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

16th June 2025

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB