By Falco

09 Jun 2025

• Tech has dominated equity investing for much of the past decade, but its portfolio monopoly is fading.

• A broader opportunity set is emerging, with a strong interest in defence, financials, industrials, and parts of healthcare.

• Defence spending is rising globally amid security concerns, while pharmaceuticals are rejoining the globalisation narrative.

• May saw the strongest sector fund inflows since late 2022, led by defence, financials, and select healthcare.

The unfolding squabble between President Trump and Elon Musk notwithstanding, we have focused on something far more interesting – emerging opportunities in equity market investing.

For much of the last decade, equity investors have relied on a single theme to deliver results: overweight tech, sit back and let a few mega-cap names such as Nvidia do the heavy lifting. The strategy proved to be efficient—too efficient, perhaps. But 2025 began to challenge that default setting. What we are seeing currently is not so much about a rotation away from tech as it is about the reality that the world is too complex, too politicised, and too fragmented for a one-sector portfolio to suffice.

Equity Market Investing—the Broadening Opportunity Set

The opportunity set in the equity market is broadening. Defence, financials, mining, and now parts of the pharmaceutical world are seeing renewed investor interest—not as tactical trades, but as durable thematic allocations that sit on firmer macro foundations than the frothy innovation narratives that earlier defined them. Allocations are becoming more nuanced, reflecting investors’ increased willingness for exposure to sectors grounded in real cash flows, policy support, and geopolitical relevance.

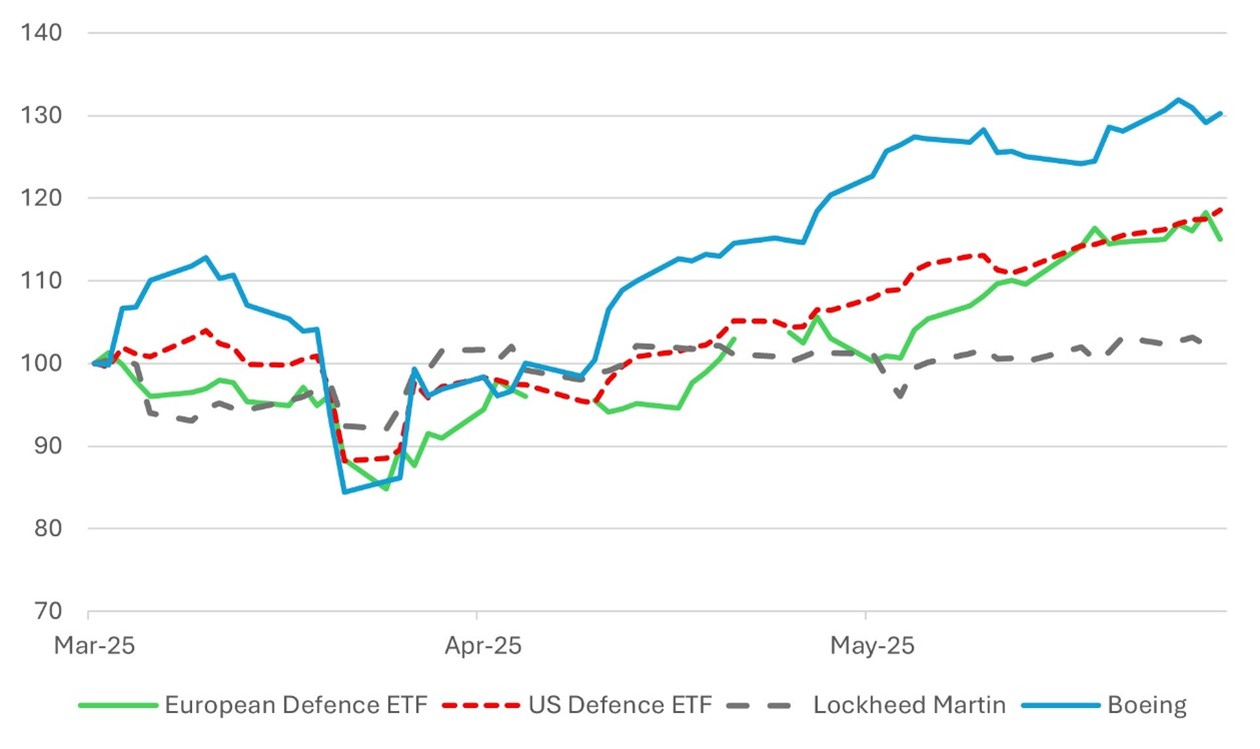

Nowhere is this more apparent than in the defence sector, which has seen renewed investor activity as elevated security concerns force countries to rearm. The world is not at war in the traditional sense, but it is clearly in a state of permanent security anxiety. Defence spending is no longer episodic—it is embedded in governments’ spending plans across the West and parts of Asia. The United States’ FY2025 defence budget, for instance, stands at a staggering $895 billion and yet is on a glide path toward $1 trillion within the next two years. Critically, this isn’t all short-cycle ammunition and logistics. Research & Development and multi-year procurement pipelines—covering space, cyber, drones, and AI—are now key growth drivers of defence spending.

Europe is finally showing signs of strategic seriousness. Germany has shaken off its post-war caution with a €100 billion special fund, while France and Poland are accelerating spending with long overdue urgency. Poland, in fact, now leads NATO in relative spending terms, allocating over 4% of GDP to defence. European spending is forecast to grow at a compound rate of 6–8% through 2030, according to the Stockholm International Peace Research Institute. That’s not a reversion—it’s a transformation.

Asia is hardly sitting still. China’s official defence budget rose 7.2% this year to ¥1.73 trillion ($238 billion) although most analysts agree the true figure is comfortably north of $300 billion once off-budget allocations are included. Japan’s military build-up is the most ambitious in a generation—Tokyo has already increased its defence budget by 16% this year alone and aims to double it to 2% of GDP by 2027. India’s defence outlays have also hit a record, with $75 billion allocated this year and a strategic pivot toward naval expansion and domestic production.

This isn't just a war story. It’s a technology story. The modern battlefield is digital, and investors have cottoned on. Year-to-date, global defence ETFs have pulled in more than $4.2 billion. Active managers are allocating funds to dual-use technologies, long-cycle capital goods, and sovereign procurement beneficiaries—names that used to be quietly ignored apart from during times of conflict. This time, it’s structural.

Chart 1: Defence Sector on the Rise in US and Europe

Index rebased to March 2025=100 Source: Bloomberg

Source: Bloomberg

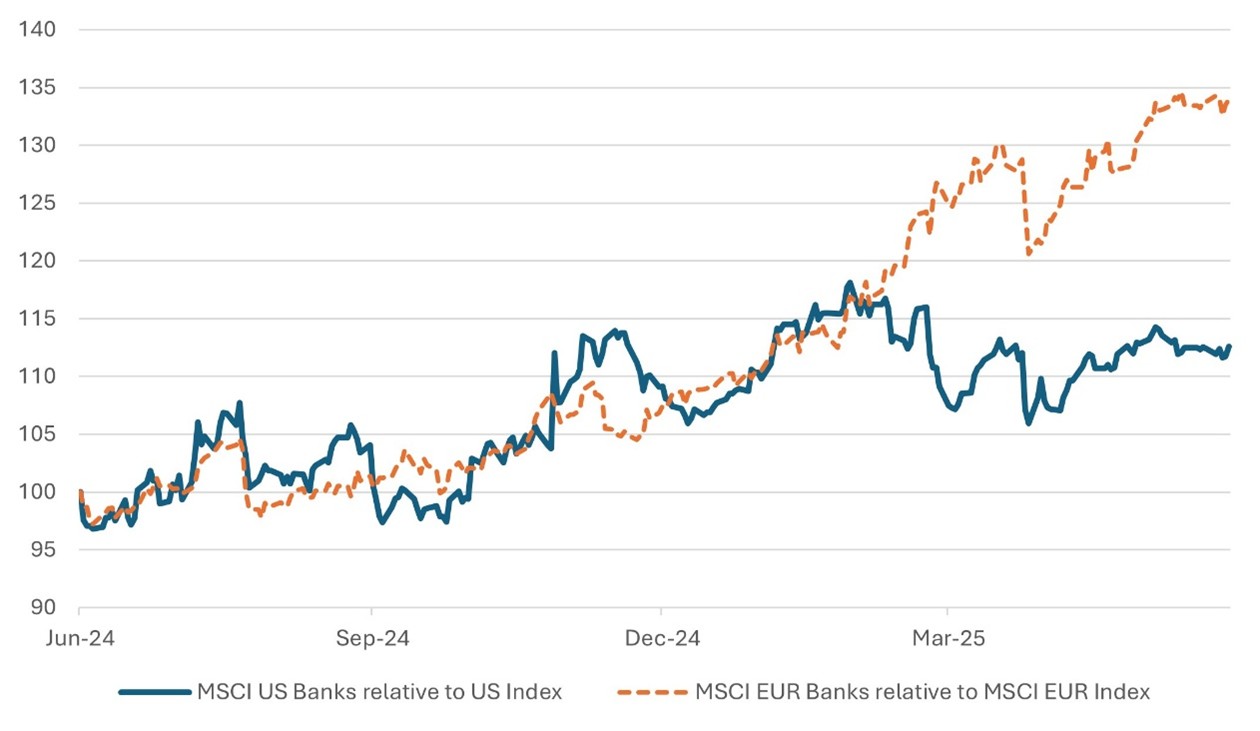

Financials, too, are back on investors’ radar. They haven’t been exciting for a decade—but that is changing now. The yield curve is finally behaving in a way that allows banks to make money again. With policy rates peaking and the long end beginning to reflect a proper term premium, net interest margins (NIM) are widening. US banks have seen three straight quarters of NIM expansion. European banks are getting a lift from steepening curves, particularly in periphery markets like Italy and Spain.

What’s notable is that the sector is finding favour without a crisis forcing a re-entry. Default rates remain contained. US high-yield defaults are still below 2%, and delinquency rates in retail and corporate credit remain benign. Meanwhile, many of these companies are trading at substantial discounts to book, even as they resume dividends and buybacks. Mutual fund flow data for May tells the story—US financials saw net inflows for the first time in nine months. The value trap, it seems, is now a carry trade.

Chart 2: Both European and US Banks Outperforming

Index rebased to June 2024=100 Source: Bloomberg

Source: Bloomberg

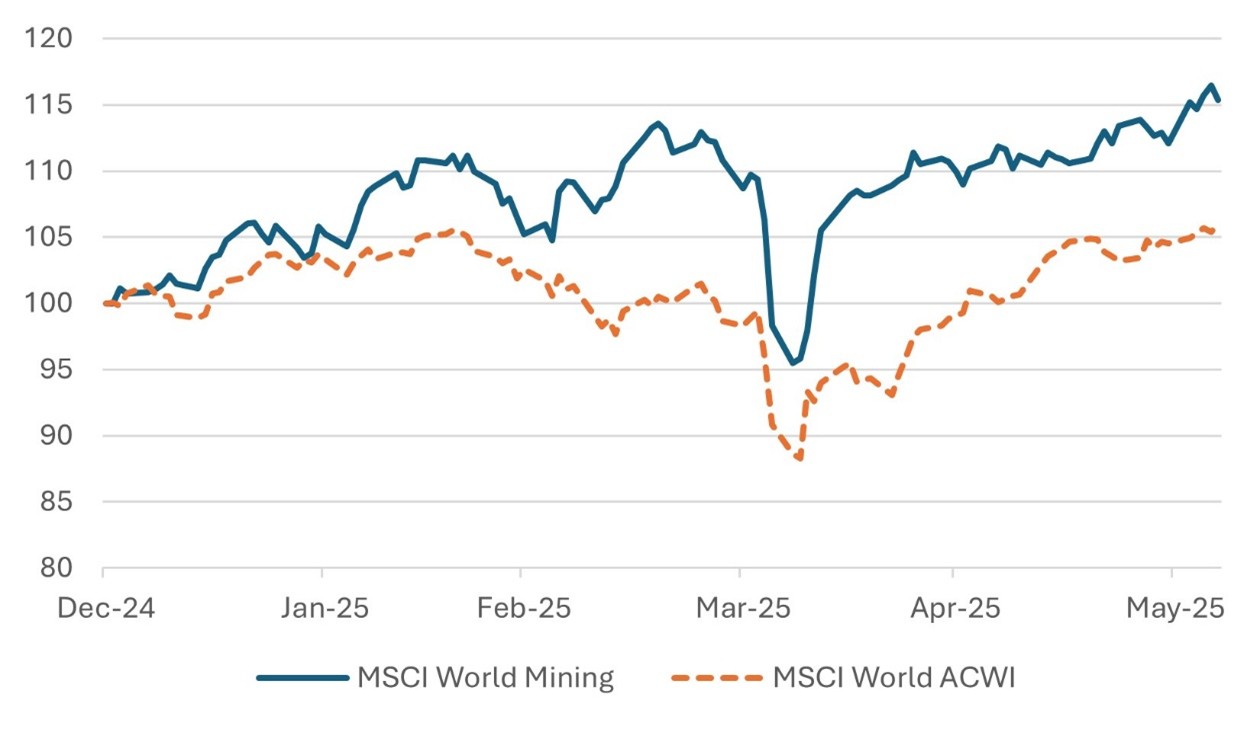

Mining and materials are reasserting their place in portfolios, not because of a sudden shift in sentiment, but because of an uncomfortable truth: we need a lot more of certain metals, and we’re not investing nearly enough to produce them. The energy transition, digital infrastructure, and geopolitical decoupling all depend on copper, lithium, nickel, and cobalt. Yet capital spending in the sector remains anaemic.

Governments are belatedly stepping in to encourage investment in the sector. The US has used the Inflation Reduction Act to subsidise domestic extraction. Europe has rolled out the Critical Raw Materials Act. China, in the meantime, is rationing its rare earth exports—weaponising its advantage with precision. The result: natural resource equity funds have seen 18% inflows this year. Even ESG funds are backtracking on their old mining taboos—relabelling key materials as “transition critical.” Scarcity is the new green.

Chart 3: Global Mining Sector Starting to Show Some Outperformance

rebased to Dec 2024=100 Source: Bloomberg

Source: Bloomberg

Pharmaceuticals, usually staid and defensive, have re-entered the globalisation story through a different lens—strategic diplomacy. In May, Pfizer signed a landmark deal with Chinese biotech 3SBio, paying $1.25 billion upfront for global rights (ex-China) to cancer therapy, with another $4.8 billion in performance-linked milestones. This is not a small partnership—it is a $6 billion handshake between East and West, structured to minimise regulatory friction by manufacturing in the US but tapping into Chinese innovation.

The context matters. China has prioritised healthcare under its “Healthy China 2030” policy, liberalising its pharmaceutical import regime while building up its domestic biotech champions. Imports of US pharma products have more than doubled since 2017. Unlike tech or semiconductors—where trade wars and sanctions dominate the narrative—healthcare is emerging as a space for quiet, mutually beneficial cooperation. Investors are noticing. Cross-border healthcare funds and global biotech strategies are seeing renewed flows.

Chart 4: MSCI China Healthcare and Bioscience Index

Index rebased to June 2023=100 Source: Bloomberg

Source: Bloomberg

Gary Dugan - Investment Committee Member

Bill O'Neill - Non-Executive Director & Investor Committee Chairman

9th June 2025

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person's sole basis for making an investment decision. Please contact your financial professional at Falco Private Wealth before making an investment decision. Falco Private Wealth are Authorised and Regulated by the Financial Conduct Authority. Registered in England: 11073543 at Millhouse, 32-38 East Street, Rochford, Essex SS4 1DB